Stock Basics

You may not trade stocks, but you should understand the basics of how they are played, as the company you work for will most likely equip you with stocks. Also many of the terms below, like long, short, and position, apply to securities like futures contracts, so being familiar with stock trading is fundamental to understanding how other, more complex financial instruments are traded.

Stock Market

A stock market, or a market where stocks are traded, is a virtual concept. A market can consist of multiple exchanges, and there are currently more than 60 exchanges worldwide, including 16 large stock markets, eight in Asia Pacific (including Australia), three in the Americas (the United States and Canada), and another five in Europe. Despite the small number of exchanges in the United States and Canada, they account for about 50% of the total global stock market capitalization.

For example, when we mention the Chinese stock market, we are actually alluding to the Chinese Shanghai Stock Exchange and the Chinese stock exchanges, and when we mention the U.S. stock market, we are alluding to the U.S. NASDAQ, NYES and AMEX.

Enterprise listing

The main purpose of a business going public is to issue shares to get stock market money, stock market investors buy the shares, and then the business can pay its employees as salary, and the employees can sell the shares in the market for cash. So the business actually uses the money from the stock market to pay salaries, feed employees, and recruit more employees to help the business grow.

However, in order for a business to go public, it must meet the listing requirements, which vary from exchange to exchange.

In addition, once a company goes public, it must disclose its earnings on a regular basis, such as quarterly earnings reports and annual earnings reports, as well as information on changes in company executives and stock purchases and sales, which must also be disclosed in a timely manner.

Companies are generally listed by IPO, and in some countries, some exchanges can be listed by DPO.

IPO

Initial Public Offering, abbreviated IPO, is the process by which a company raises money from the market by issuing new shares on top of its existing stock. For example, the company registered 10,000 shares of stock, and then choose to issue 1,000 new shares, then the company will spend money to hire underwriters, underwriters are generally investment banks, underwriters will contact other investment institutions, the issue price, time, size of the road show inquiries, and finally finalize the issue price, and then the company issued the 1,000 new shares first in the primary market sales, the primary market investors include the previously contacted investment institutions, in addition to now also allow ordinary investors to participate in the first level of listed transactions, that is, ** playing new shares **. After purchasing the shares, the primary market players then trade in the secondary market, which is also the standard stock market, where the final market value of the company is the share price multiplied by 11,000 shares (10,000 original shares + 1,000 new shares).

When a company goes public through an IPO, the original shareholders generally have a certain lock-up period, in other words that original 10,000 shares cannot leave to be sold off. This lock-up period is agreed upon with the underwriters and institutions before the sale on the primary market, otherwise the institutions will worry about the original shareholders of the company quickly cashing out. The lock-up period is usually 180 days.

In addition to the agreed-upon lock-up period, there may also be some legal restrictions on the lock-up. For example, in the U.S., the SEC's Rule 144 also governs the sale of shares, and the rules therein are not specific to IPOs, but are to be observed for any period of time. https://www.sec.gov/reportspubs/investor-publications/investorpubsrule144htm.html

IPO issue price finalization mechanism:

- The fixed-price offering mechanism means that before a public offering of a company's shares, the company and the underwriters determine a fixed offering price to sell the shares, which is often determined using relative valuation methods such as the price-to-earnings ratio. The fixed-price offering mechanism is simple, straightforward and inexpensive, but the entire process lacks interactive games between underwriters and investors, resulting in a less marketable offering price.

- Under the cumulative bid and ask system, the underwriters determine the initial price range based on the valuation of the company to be issued, and then introduce the issuing company to potential investors through road shows and other means, allowing institutional investors to declare the number of subscriptions within the price range according to different issue prices, after which the underwriters aggregate the information and calculate the total subscription volume, and use it to determine the issue price of the IPO and the placement rules to investors according to the predetermined Placing. The main reference for IPO pricing is the share purchase applications submitted by institutional investors during the cumulative bidding period. The cumulative tender offer system is highly market-oriented and can effectively reduce the degree of information asymmetry between issuers and investors, and is currently one of the most commonly used IPO pricing mechanisms in the world, especially in countries with a high proportion of institutional investors such as the UK and the US.

- Auction mechanism means that underwriters first collect information on price and quantity demand from investors, and then determine the issue price of shares based on investors' bidding results. The auction pricing mechanism can maximize the exploration of the investment value of the company's shares, keep the issue price close to the fair market value, and allocate shares according to the high or low investor bids. It is currently used mainly in continental European countries, Japan, and Taiwan, China.

- The hybrid issuance mechanism refers to the use of different pricing mechanisms for different shares in one IPO process. The use of a mixed issuance mechanism can play the leading role of institutional investors in pricing the issue while protecting the interests of small and medium-sized investors to a certain extent.

In practice, a mix of cumulative bid-quote mechanism and fixed-price issuance mechanism is most commonly used, with the former targeting institutional investors to make IPO pricing reflect market demand and the latter mainly issued to small investors to protect their interests in IPO subscriptions and not involved in IPO pricing. The hybrid issuance mechanism is widely used in markets with a high degree of internationalization and a high proportion of retail investors, such as Hong Kong stocks.

Primary Market

The primary market, or issuance market, is the market where companies issue securities, contact institutions through underwriters, and then institutional investors purchase the company's securities.

Nowadays, investments in companies before they go public, such as VC, PE and other private equity investments, are also generally referred to as primary market investments.

Secondary Market

The secondary market, which is the market where investors trade with investors, is most typically the stock market.

The secondary market is of course also liquid due to its heavy participation.

What is liquidity? You can search for "liquidity" on this site

Direct Public Offering (DPO)

Direct Public Offering, or DPO for short, is a new way of going public as opposed to an IPO.

A DPO differs from an IPO in that

- Instead of contacting primary market players through underwriters, the company sells directly on the secondary market.

- There are no new shares to be issued and no so-called lock-up period. Assuming the company is registered with 10,000 original shares, those 10,000 shares held by the original shareholders could theoretically be traded immediately after the secondary market listing. (But still subject to the SEC's rule 144).

The main advantages of a DPO are.

- Companies don't have to spend money on underwriters, which is not a small amount of money.

- The IPO process is longer, as it can take up to 1 to 2 years to contact the underwriter, who then contacts the institutional roadshow.

- It is more friendly to the original shareholders of the company, for example, the employees of the company can cash out quickly.

- Fairer to all traders in the market, as in the case of an IPO, secondary market traders have to wait for primary market investors to buy first.

The main disadvantages of DPO are.

- With the DPO approach, the firm does not issue new shares, whereas with the IPO approach, the firm issues new shares that can immediately capture a huge amount of money from the market.

- Since there is no participation of underwriters and primary market institutional investors, the share price volatility after a DPO can be high, and this volatility is one of the reasons why some companies have been hesitant to go public directly.

- Without a lock-up period, employees and early stage investment capitalists could theoretically sell their shares quickly, and a plunge in the share price could cause employees as well as investors to lose confidence in the business. The impact of this is relatively large, so there are companies that have tried to set up their own internal lock-up periods.

DPOs are rare in the history of the U.S. stock market, and only a few well-known companies have taken this approach, such as music streamer Spotify and instant messaging software Slack.

Delisting (Unlisted)

After a company goes public, it is required to delist after a period of time when it no longer meets the exchange listing requirements. At that point, the company must request to buy back its shares at a certain price and return the money to the stockholders.

Some companies, too, may choose to delist when they believe that the disclosure required for listing leads to high share price volatility, which affects corporate decisions or employee confidence, or for other reasons.

Stock Code (Symbol)

A company listing must apply to an exchange for a unique number that is not used by other companies. This number identifies the company's stock, and traders trade by entering the number to locate and trade the stock. This number is exchange related and varies from exchange to exchange, for example, Apple's number is AAPL and Maotai's number 600519.

Note that a company can be listed on two exchanges, so that two different numbers can be used. For example, Ali is also listed on the NASDAQ exchange in the U.S., with the number BABA, and on the Hong Kong Stock Exchange, with the Hong Kong stock number 09988.

Price (Price) and volume (Volume)

After a stock is issued, there will be an initial pricing, which is mainly done by the primary market institutions.

Investors will judge whether they need to buy the stock according to the company's prospect, and some people will choose to sell after buying the stock and waiting for the price to rise.

In addition, the stock exchange also counts the cumulative number of daily transactions of a stock, called volume, and the volume data can also show how active a stock trader is.

Quote (bid and ask), 5-step, 10-step

Buyer-seller offers are made using the offer queue, using Apple as an example, assuming the current Apple share price is 400. The left side shows the buyer's offer, also called bid

- (buy 1) buy offer 399.5, quantity 100

- (buy 2) buy offer 399.2, quantity 300

- (buy 3) Buy offer 398.5, quantity 200

- (Buy 4) Buy quote 397.4, quantity 1000

- (Buy 5) Buy offer 397.0, quantity 500

The right side shows the seller's offer, also called ask

- (Sell 1) Buy offer 400.3, quantity 300

- (SELL 2) Buy offer 401.2, quantity 200

- (SELL 3) Buy offer 402.5, quantity 100

- (SELL 4) Buy quote 404.0, quantity 600

- (SELL 5) Buy quote 404.5, quantity 400

In other words, the sale transaction must be either the seller compromise, or the buyer compromise, or both sides happen to agree on a certain price to deal with the deal after the sale.

Suppose a seller suddenly decides to sell 200 shares at 399, then priority will be given to the 100 shares of Buy 1 and the 100 shares of Buy 2. At this point, Buy 2 still has 200 shares outstanding, and his offer becomes the highest buyer's offer, so Buy 2 becomes Buy 1, and the quantity is 200. The buyer's offer queue collectively moves up one frame: (Buy 1) Buy offer 399.2, quantity 200

- (Buy 1) Buy offer 399.2, quantity 200

- (Buy 2) Buy offer 398.5, quantity 200

- (Buy 3) Buy offer 397.4, quantity 1000

- (Buy 4) Buy offer 397.0, quantity 500

- (Buy 5) Buy offer xxx, quantity xxx

At this point suddenly someone is willing to buy 400 shares at 399, that is, the second highest bidder, then the buyer's offer queue becomes

- (Buy 1) buy offer 399.2, quantity 200

- (Buy 2) Buy offer 399.0, quantity 400 --> new buyer

- (Buy 3) Buy offer 398.5, quantity 200

- (Buy 4) Buy quote 397.4, quantity 1000

- (Buy 5) Buy offer 397.0, quantity 500

So the quotes are sorted by price, not time, which is the same as buying groceries at the market. As a buyer, the higher the quote, the higher the priority of the deal, and as a seller, the lower the quote, the higher the priority of the deal.

If you can see all the quotes queue of buyers and sellers in the market, then you will have a clear picture of the power of buyers and sellers in the market, but the exchange will not give information about all the quotes in the queue, usually only the 5 top buyers' quotes and sellers' quotes will be given, which is 5 files, then sometimes you can get 10 files of quotes by paying.

In addition, some exchanges can even provide more quotes for a fee.

Market Cap and Outstanding Shares

The shares issued by a company after going public can be divided into liquid and non-liquid, those traded on the secondary market are called liquid shares, and those held by insiders who cannot be traded at the moment are non-liquid shares.

The market capitalization of a company is the share price multiplied by the number of outstanding shares.

Trading Hours

Stock trading does not take place 24 hours a day, it starts at a certain point in the day and ends at a certain point in time, the start point is called the opening and the end point is called the closing. Some countries' stock markets, such as the U.S., allow trading for a period of time before the opening and after the closing of the market as well, so trading hours are divided into three parts.

- Regular Session

- Pre-market session

- After-hours session

K-line(OHLCV)

For investors, there are 4 important prices for a stock day.

- The opening price: Open Price

- The highest price of the day: High Price

- The lowest price of the day: Low Price

- Closing Price: Close Price

Plus volume Volume, referred to as ohlcv, if you do not count v volume, the daily ohlc can be drawn as a bar or candle, and then the days of the bar connected to see it is called k-line.

The following chart is a section of Apple's k-line chart.

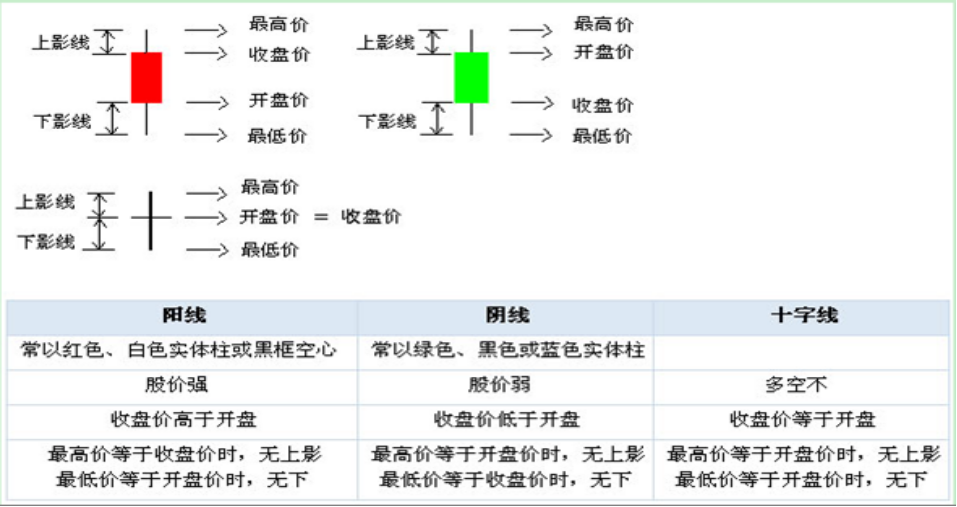

As can be seen from the chart, the table above shows the k-line and the table below shows the volume. The k-line is connected one by one ohlc bars, and each bar is composed of a shadow line and a solid. The part of the shadow line above the entity is called the upper shadow line, and the part below is called the lower shadow line. The entity is divided into a positive line and a negative line. The shadow line indicates the highest and lowest price traded on the day, while the entity indicates the opening and closing price of the day, so that one bar completely contains the information of the ohlc.

The k-line can be either by day, or by week, month, or year. The k-lines drawn according to time are called daily, weekly, monthly and yearly. The weekly line, for example, is to count the ohclv within a week.

Candlestick Charts Candlestick charts, Japanese lines, yin and yang lines, bar lines, etc. are commonly referred to as "K lines". It originated from the rice market in Japan in the 18th century during the Tokugawa Shogunate period (1603-1867) and was used to calculate the daily rise and fall of rice prices. After more than 300 years of development, it has been widely used in the stock market, futures, foreign exchange, options and other securities markets.

The so-called technical analysis of stocks, or chart analysis, is actually the analysis of K-line charts to determine the next trend of stocks.

Financing、Leverage

Financing, or borrowing money, for stock traders is borrowing money to speculate on stocks, for example, if you have 100 principal, you can borrow 200, so that the total is 300 and you use three times leverage. In this era of low interest rates, leverage can sometimes make you rich quickly, but of course, leverage is also a double-edged sword, your risk is also magnified, three times the leverage, once down 33%, your principal will be almost completely lost. Leverage will increase your margin, in addition to the margin varies from broker to broker, the type of securities you hold also has an impact on the margin, for example, some ETFs that are inherently leveraged, holding will take up more margin.

Long Stock、Short Stock、Short Cover

Buy stocks (or other securities such as futures contracts), also called more, the purpose of doing more, of course, is to sell low and buy high, so there will be selling operations later.

Shorting, also known as finance, simply put, is to borrow a stock from someone else, and then sell it at the current price, and then buy it back after the stock price drops (this operation is called back cover, the English name short cover), so you can earn the difference.

So going long on a stock is hoping to buy low first and sell high later, while going short is, selling high first and buying low later.

Shorting is only allowed in some countries' stock markets.